Page content

How Did 2024 Treat European Fintechs

Reading Time: 3:30 Minutes

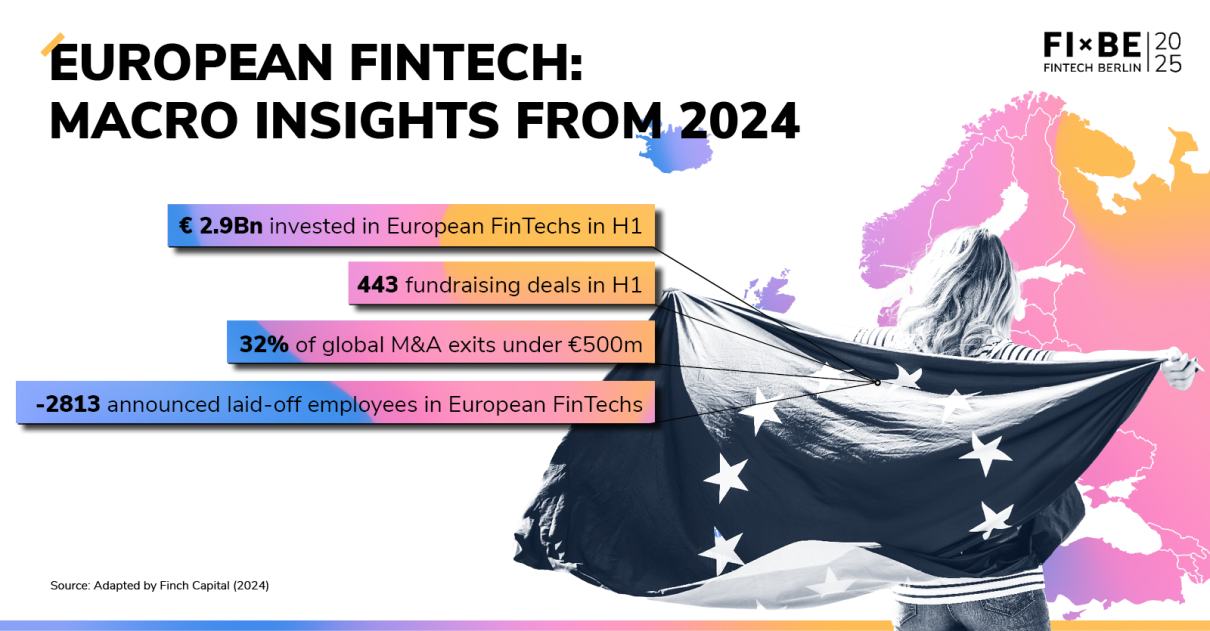

In 2024, European fintech turned economic challenges into opportunities for innovation. From record-breaking valuations to cross-border partnerships, the year underscored how agility and forward-thinking can propel the industry even in uncertain times.

Let’s explore the key highlights of this transformative year.

Neobanks: The Comeback Stars of 2024

2024 marked a remarkable turnaround for European neobanks, proving they could not only survive economic shifts but thrive in a rising interest rate environment.

What’s driving this success? First, neobanks benefitted from increased net interest margins, a boost provided by higher interest rates.

Additionally, their early cost-cutting measures during the 2021–2022 downturn positioned them well to capitalize on renewed demand. By diversifying revenue streams—adding subscription services, trading tools, and foreign exchange offerings—they’ve built resilience into their business models.

Industry leaders Revolut and Starling Bank posted record-breaking profits of £438 million and £301 million, respectively, highlighting how these digital-first banks have adapted to new realities.

Monzo, once synonymous with growth-stage struggles, has transformed into a profitability-focused powerhouse, with £880 million in revenue. Its strategic pivot toward SME lending and innovative subscription products played a significant role.

Nordic Fintech: Quiet Powerhouses

The Nordic region stood out in 2024, blending stability with a focus on larger, more mature investments. With $38 billion YTD 2024 raised —a 352% increase from 2023—the Nordics demonstrated their strength as a fintech hub.

Much of this surge was driven by landmark ventures like EQT’s €22 billion mega fund, signaling a preference for scaling established players over early-stage startups.

Among the key players was Holvi, a Finnish fintech that continued to expand its footprint by introducing tailored solutions for freelancers and solopreneurs—a booming demographic in the region.

Another Finnish fintech standout is Enable Banking which offers a secure API connecting to over 2,500 banks driving open finance innovation across Europe. Its expansion into 29 markets in 2024 has solidified its position as a leader in simplifying PSD2 integration for businesses.

Although not Nordic, Berlin-based Qwist has also been influential in the region. Known for its rapid account-switching solutions, allowing businesses to manage cross-border payments in under 10 minutes, streamlining what was once a time-intensive process.

Success Stories to Celebrate

Qonto, a leading French fintech offering digital banking solutions for SMEs and freelancers, had a banner year. The company expanded its services across Europe, launching in two additional markets and reaching over 750,000 active customers. Qonto also introduced advanced budgeting tools and real-time team expense management features, further solidifying its position as a leader in digital business banking.

Its growth was buoyed by a €100 million funding round early in 2024, aimed at accelerating product development and scaling operations in underserved European regions. Qonto's ability to blend seamless user experience with robust financial tools has made it indispensable for startups and SMEs navigating complex financial landscapes.

Another standout story from 2024 is Wise, a London-based fintech revolutionizing cross-border payments. Wise reported a 35% growth in transaction volumes, driven by its multi-currency investment feature, which allows users to earn returns on balances held in over 20 currencies. This innovation catered to SMEs and individuals navigating the complexities of global finance.

What’s Next for European Fintech?

Klarna's IPO: A Bellwether Moment for Fintech

Klarna's anticipated IPO in 2025 has become a focal point for the fintech industry, poised to set the tone for a wave of public listings. If it is successful, it could rekindle investor interest in fintech public offerings—a sector that hasn’t seen significant activity since 2021. This moment could also signal a shift in market expectations for profitability and scalability in newly listed tech companies.

Central to Klarna’s narrative is its integration of AI, leveraging large language models (LLMs) to enhance customer service. This focus on scaling automation effectively and transparently has been highlighted as part of its pitch to Wall Street.

In many interviews, Klarna’s CEO has emphasized a pragmatic approach to AI, addressing specific customer service challenges and scaling these solutions incrementally. This strategy is seen as a smart move to build confidence among potential investors.

How PSD3 will shape Fintech Growth

Let’s break down PSD3—the European Union’s next step in reimagining the financial services landscape. In 2024, it laid the foundation for innovation while addressing long-standing challenges in open banking, security, and regulation.

In 2025, PSD3 has the potential to transform open banking, making it easier and safer for fintechs to access and use consumer financial data—with consent, of course. Transactions grew by 35% across Europe, fueled by standardized APIs and streamlined processes. Companies like TrueLayer and Tink led the charge, expanding their platforms to deliver seamless integrations for third-party developers.

Another major win? Fraud prevention. PSD3 builds on the foundation set by its predecessor, PSD2, by enhancing security measures like Strong Customer Authentication (SCA) and introducing stricter requirements for transaction monitoring. These updates are designed to further reduce online payment fraud, a trend already observed under PSD2.

But perhaps the most exciting change is how PSD3 is broadening the playing field. By regulating embedded finance solutions, non-financial players—think e-commerce platforms—can now integrate payment services directly into their ecosystems. Leaders like Adyen and Marqeta are thriving, as businesses seek seamless ways to deliver financial services to their customers.

Conclusion

2024 was a year of resilience and transformation for European fintech. From neobanks thriving in a challenging economic landscape to regulatory innovations like PSD3 driving the industry forward, fintechs proved their ability to adapt, innovate, and lead. As we look ahead to 2025, the stage is set for even greater growth, collaboration, and breakthroughs in shaping the future of finance.