Page content

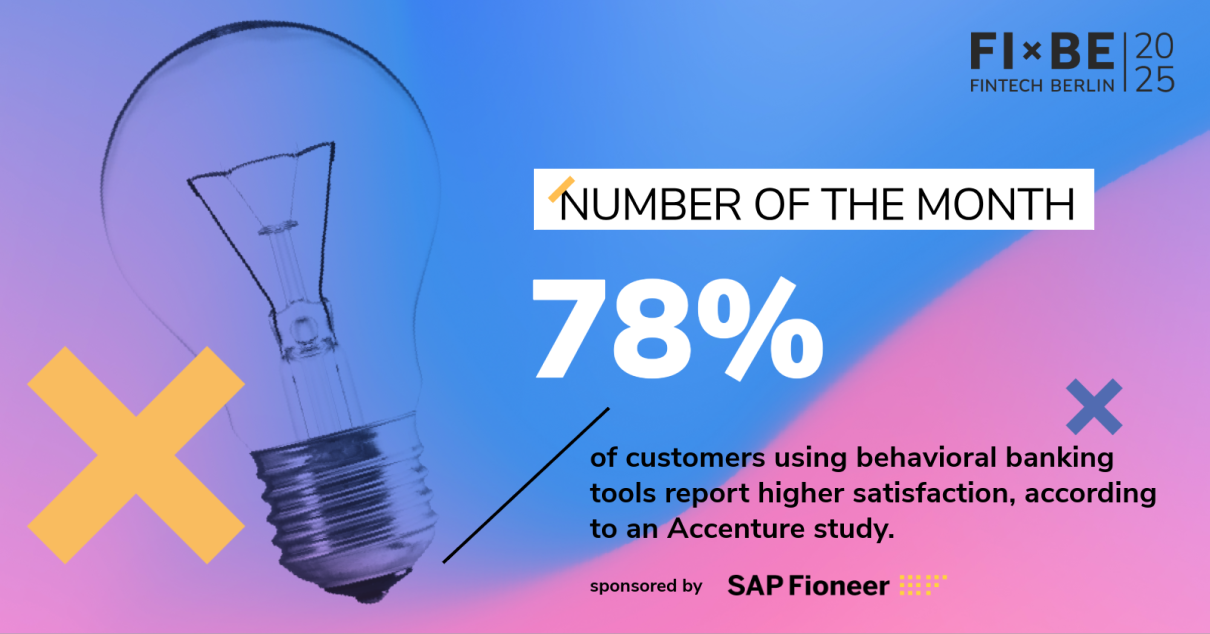

Number of the Month

Behavioral banking tools enable financial institutions to offer personalized services by providing real-time insights into customers’ needs and preferences to analyze the customer behavior. This personalization can lead to improved customer satisfaction and loyalty. By understanding customer behavior patterns, banks can better detect and prevent fraudulent activities. This proactive approach to security is another reason why customers feel more satisfied and secure with their financial institutions.

Behavioral banks, like Discovery Bank, use behavioral research to encourage good financial habits among customers. This approach not only helps customers manage their finances better but also contributes to their overall financial well-being. To motivate customers and to increase their satisfaction and engagement with the bank. Behavioral banks often use incentives and rewards to nudge customers towards positive financial behaviors. For example, customers might receive rewards for saving money or making timely payments. Which leads to a more satisfied customer.

Check out SAP Fioneer's blog to learn more about how behavioral banking supports customer loyalty and income.

Article sponsored by SAP Fioneer