Page content

How 2024 Is Redefining the Crypto Markets

Reading Time: 3:30 Minutes

The first half of 2024 is becoming a turning point for the cryptocurrency market, characterized by significant developments that underscore the growing integration of crypto into the global financial system.

Among these, two standout milestones—the launch of the first U.S. Spot Bitcoin exchange-traded fund (ETF) and the rapid adoption of the PayPal USD (PYUSD) stablecoin—are pushing crypto markets further into the mainstream and challenging the dominance of traditional financial products.

In this article, we'll explore how innovations like these are shaping the future of crypto by redefining the role of digital assets in both investments and everyday financial practices.

The Landmark Bitcoin ETF

The January 2024 launch of the first Spot Bitcoin ETF in the United States marks a key crossroad for cryptocurrency markets. After years of regulatory scrutiny and anticipation, the Securities and Exchange Commission (SEC) approved a Spot ETF that tracks Bitcoin, providing a regulated and simplified route for investors to gain exposure to the most widely recognized cryptocurrency - making it more accessible to a larger audience, including those who may have been hesitant to invest directly in cryptocurrencies due to the complexities of crypto trading platforms and crypto exchange, and the concerns about crypto security.

This milestone aligns with the growing momentum in crypto regulations, including the anticipated EU MiCA (Markets in Crypto-Assets) regulation, which seeks to unify and strengthen the European cryptocurrency market by establishing a comprehensive regulatory framework.

Within the first three months, the Spot Bitcoin ETF attracted $12 billion in inflows, reflecting vigorous demand from institutional and retail investors. This outstanding success is part of a broader trend with 208 products, 551 listings, and $82.27 billion of assets invested in crypto in ETFs and the exchange-traded products (ETPs) from 47 providers listed on 20 exchanges in 16 countries.

Moreover, seeing financial giants like BlackRock taking an active role here, is demonstrating an increasing appetite from institutional investors to bet on Bitcoin and crypto in general, demonstrating a growing confidence in Bitcoin as a legitimate investment.

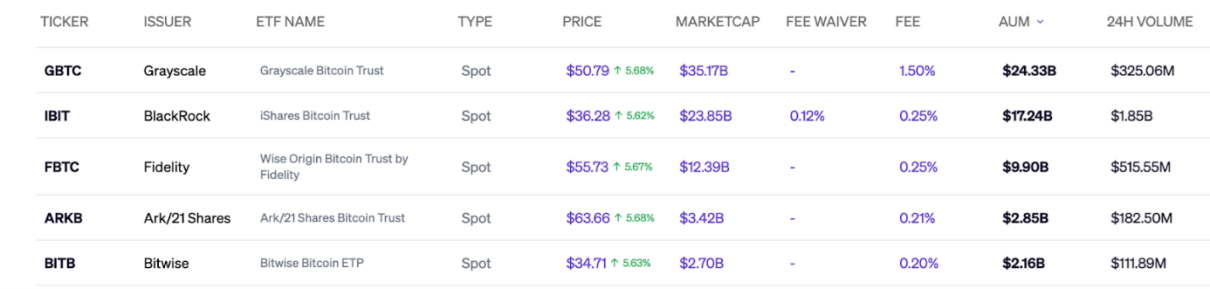

As of August 2024, the Grayscale Bitcoin Trust (GBTC) is the largest Bitcoin exchange-traded fund with a market capitalization of $35.17 billion and assets under management (AUM) of $24.33 billion, followed by BlackRock's iShares Bitcoin Trust (IBIT), Fidelity's Wise Origin Bitcoin Trust (FBTC), Ark/21 Shares Bitcoin Trust (ARKB), and Bitwise Bitcoin ETP (BITB).

Source: Blockworks - Bitcoin ETF tracker - 26/08/2024

PayPal’s PYUSD: A Game-Changer in Digital Payments?

If Bitcoin and its Spot ETF have dominated headlines throughout the year, the PYUSD stablecoin has emerged as another major innovation in crypto. Launched in 2023, and gaining substantial traction in recent months, PYUSD is a stablecoin pegged to the U.S. dollar, designed to facilitate digital payments and cross-border transfers.

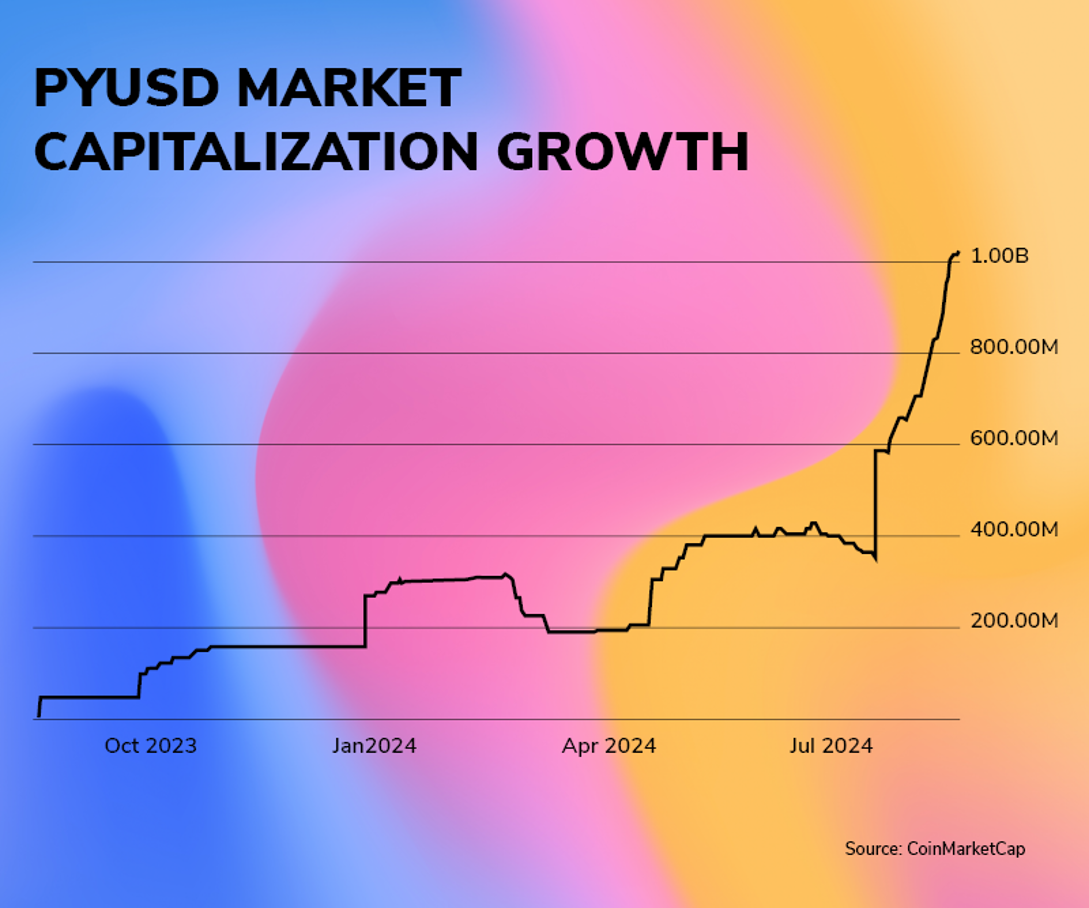

By the 26th of August 2024, PYUSD had surpassed the $1 billion milestone in market capitalization, with a notable 67.4% increase just in the last month.

Source: CoinMarketCap - PYUSD market capitalization growth since its launch in August 2023.

Since its expansion to Solana in May 2024, PYUSD has experienced a substantial surge in market capitalization, with about 64% of its total liquidity now concentrated on this blockchain. Solana’s low transaction costs and high efficiency have made it an attractive option for digital payments, offering efficiency and scalability for users.

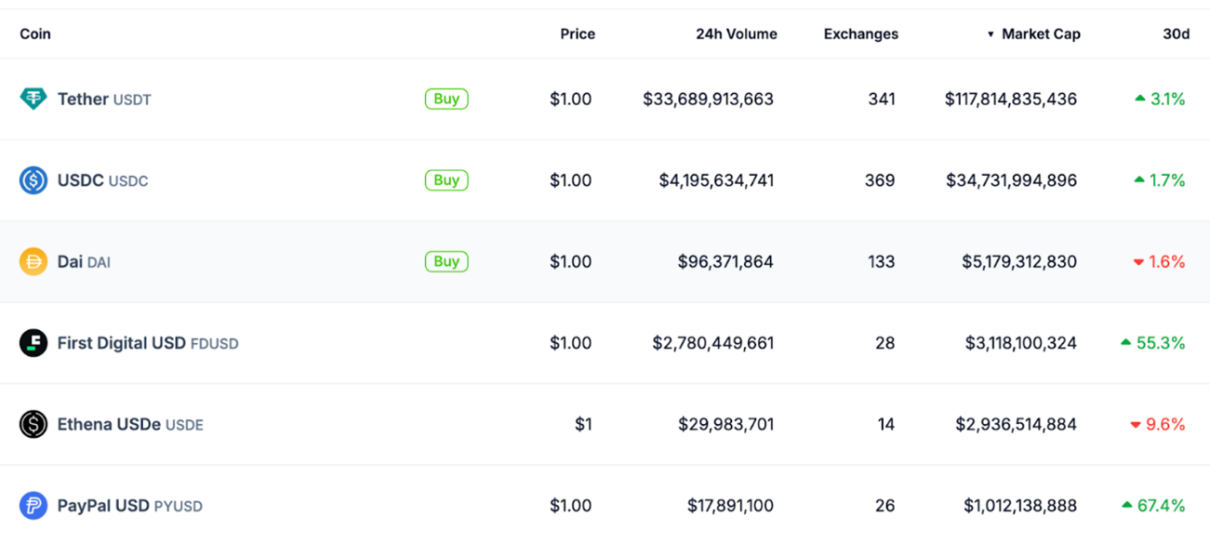

Despite facing challenges in user adoption compared to leading stablecoins like Tether (USDT) and USD Coin (USDC), which continue to own a large percentage of the market share, PYUSD has rapidly ascended the ranks. Now it is in fact the third-largest stablecoin on Solana and the sixth-largest globally—a remarkable achievement for a stablecoin launched just a year ago.

Source: Coingecko - showing the most popular stablecoins by market capitalization on 26/08/2024.

PayPal has also integrated PYUSD into its global payment infrastructure, highlighting its strategic approach to bridging traditional financial systems with digital currencies. Through its subsidiary Xoom, PayPal allows users to transfer PYUSD to over 160 countries, with no fees for users outside of Hawaii. This innovation is helping to rethink cross-border payments in a digital-first world, showcasing the future of cryptocurrency in global transactions and the larger role of crypto projects in reshaping financial services.

The Impact on the Broader Crypto Market

The U.S. Spot Bitcoin ETF and PayPal’s PYUSD stablecoin successes demonstrate how 2024 is transforming the cryptocurrency landscape. The ETF has opened the doors for institutional investors, driving significant inflows and increasing market liquidity. Simultaneously, PYUSD’s success showcases how established fintech players like PayPal can still innovate.

These developments highlight a widespread trend where financial institutions and payment platforms increasingly integrate digital assets into their services, while the adoption of regulated financial products legitimizes cryptocurrencies in the eyes of financial incumbents, institutions, and the general public.

We are now expecting that these developments will fuel further adoption, particularly as more companies, inspired by these successes, and reassured by greater regulatory clarity, will start exploring crypto and blockchain technology for a wide range of products and services that go beyond the hype and speculation of the early days, making digital assets more accessible, useful and integrated into the global financial system.