Page content

Cybersecurity and Compliance in Nordic Fintech

Reading Time: 4 Minutes

The Nordic fintech scene is one to watch, with Sweden, Finland, Norway, and Denmark leading in secure financial technology.

As digital finance grows, two key priorities have become clear: the need for strong cybersecurity to guard against rising digital threats and the importance of regulatory compliance, especially with the MiCA (Markets in Crypto-Assets) regulation coming into place in 2025.

For fintech companies, these efforts are essential to building a secure, reliable space for digital transactions. Here’s a look at how Nordic fintech firms are addressing these challenges with a focus on security, compliance, and innovation.

Rising Security Threats in Crypto: The Impact of Exchange Hacks

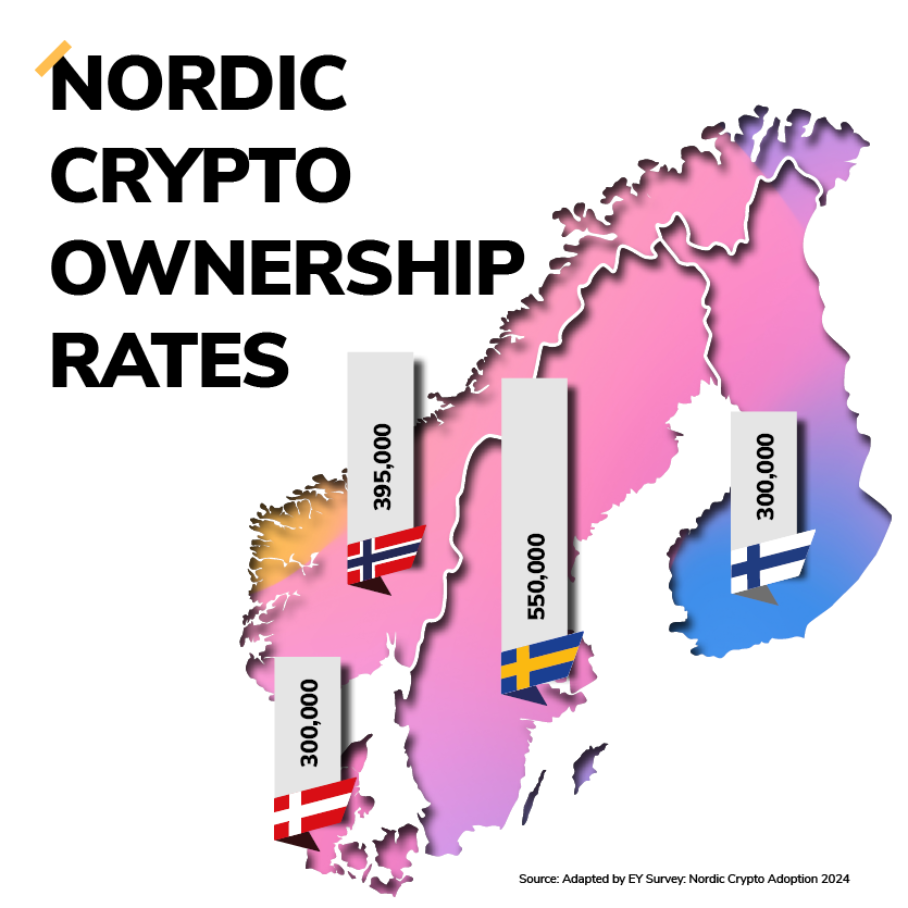

Cryptocurrency has become an asset of interest in the Nordics, with 7% of adults now holding crypto—that’s about 1.5 million people across the region. Sweden leads with around 550,000 crypto owners, followed by Norway, Denmark, and Finland (EY Nordic Crypto Adoption Survey).

This growing engagement with digital assets comes as the Markets in Crypto-Assets (MiCA) regulation moves toward implementation across the European Union.

Set to be enforced in phases starting in 2024 and fully implemented by 2025, MiCA will establish a unified regulatory framework for crypto assets, creating consistency across member states. Its main aim is to enhance consumer protections, enforce transparency standards, and standardize anti-money laundering (AML) requirements.

However, with increasing crypto adoption also comes increased risk. Globally, several high-profile hacks of crypto exchanges have made headlines and users were left with extensive financial losses.

The Nordics have also seen some prominent hacks in recent years. In 2019, Bitcoin Norway fell victim to a SIM swap attack that let hackers into user accounts, leading to significant financial losses and exposing gaps in exchange security. Then, in early 2020, the IOTA Foundation faced a major breach when hackers found a way into its wallet software, stealing funds from users across Europe, including the Nordic region.

In response to all these potential security threats, Nordic fintech Firi, the region’s largest crypto exchange, is leading the way by prioritizing security and compliance with MiCA’s evolving standards. Firi integrates multi-factor authentication (MFA) and end-to-end encryption to ensure secure transactions, and its focus on regulatory alignment provides users with a safe trading environment.

And there is Safello, a Swedish fintech specializing in crypto brokerage, that has taken proactive steps to align with MiCA’s principles. Known for its commitment to compliance, Safello focuses on secure transaction processing and AML practices that meet high regulatory standards.

Rising Cybersecurity Investments in Nordic Fintech

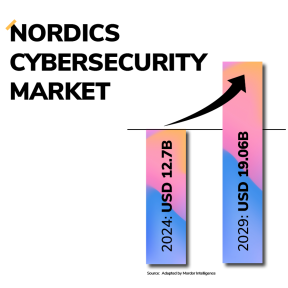

With digital threats growing, Nordic fintech companies are ramping up their investments in cybersecurity. The region’s cybersecurity market is expected to grow from USD 12.70 billion in 2024 to USD 19.06 billion by 2029 (Mordor Intelligence).

With rising cyber threats, fintech companies are exploring new ways to secure financial data—and blockchain is proving to be one of the most effective tools for the job.

So, why is blockchain becoming such a powerful tool for cybersecurity? At its core, blockchain provides a decentralized, tamper-resistant ledger, where transactions are verified across multiple points, making unauthorized changes nearly impossible. For fintechs, this means a stronger defense against fraud and better data integrity.

Leading Nordic Blockchain Companies Prioritize Cybersecurity for Fintech

With its roots in Scandinavia, Chainalysis offers tools that follow the flow of funds in crypto transactions, helping companies detect and stop fraud before it becomes a bigger issue. By tracing suspicious activity back to its source, Chainalysis makes it easier for financial institutions to stay compliant and prevent money laundering.

Meanwhile, Concordium in Denmark has taken a different approach, building identity verification directly into its blockchain so that each transaction is automatically verified. This extra layer of security helps companies and users alike trust that every transaction is secure and compliant.