Page content

AI, Profitability and Sustainability in Fintech 2024

Reading Time: 4:30 Minutes

The fintech sector in 2024 demonstrated resilience and adaptability, navigating well a consolidating market where investments stabilized, and both investors and companies prioritized profitability and sustainable business growth.

Here, we examine the key developments of a year shaped by the transformative impact of AI, significant new regulations, and other meaningful changes that have laid the foundation for more fintech innovations.

The Year of AI in Fintech

Artificial intelligence took center stage in fintech and the broader tech industry, accelerating innovation and expanding use cases across fraud detection, compliance, risk assessment, customer service, personalized financial services, and more Generative AI enabled the creation of synthetic datasets for risk modeling and enhanced predictive analytics, while AI-powered chatbots drove a new transformation in customer engagement.

Overall, AI in fintech had an undeniable impact on compliance, on elevating payments and cybersecurity as well as on ESG and sustainable finance, with some noteworthy potential also on financial inclusion.

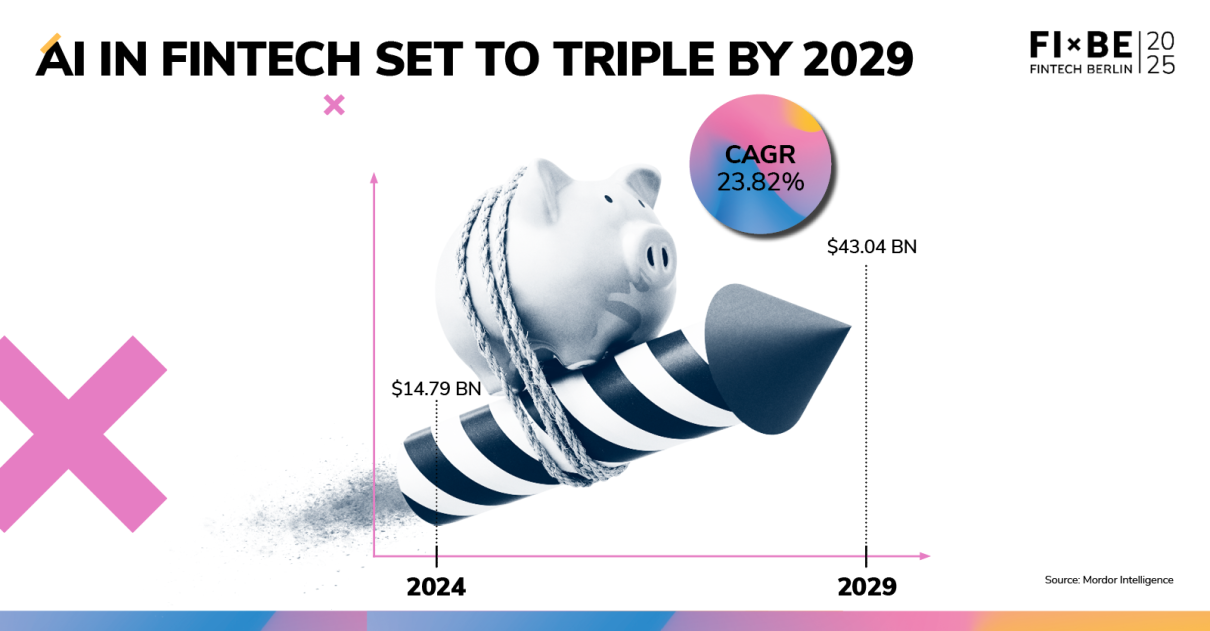

Mordor Intelligence estimates a market size for AI in fintech of $14.79 billion this year, with a compound annual growth rate (CAGR) of 23.82%, and a forecast to reach $43.04 billion by 2029. So if what we experienced in 2024 seems impressive, it appears we’ll see a much bigger transformation in the years to come.

When Neobanks Turned Profitable

With a shift in venture capital investments, profitability became a defining theme and a necessity for fintech startups of any size. In 2024 we saw some concrete progress with multiple neobanks reporting profits after years where they mostly focused on aggressive growth. Some notable examples are:

- N26: The Berlin-based neobank reported its first quarterly profit in Q3 2024, with a net operating income of €2.8 million. Following BaFin's lift of growth restrictions in June 2024, N26 accelerated its growth momentum, adding over 200,000 new sign-ups per month. The company projects a 40% increase in annual revenue, reaching approximately €440 million by the end of the year.

- Nubank: The Brazilian digital bank reported in Q2 2024 a net income of $487 million, more than doubling year-over-year through its extensive customer base in Latin America and expanded product offerings, proving the viability of digital-first banking models in emerging markets.

- Revolut: The London-headquartered fintech reported in July a record pre-tax profit of £438 million for 2023, compared with a loss of £25 million for the previous year, after revenues nearly doubled to £1.8 billion.

- Bunq: This Dutch neobank, one of the largest in Europe with 11 million users in Europe and more than €7 billion in deposits, reported €53.1 million in net profit for 2023, and announced plans to expand into the UK.

A Big Year for Regulations

Regulations are maybe not the most exciting theme, but they are having a substantial impact in reshaping the fintech industry and the way fintech startups, corporations, and financial institutions operate. A few key regulations that have been approved or entered into force in the last year, are:

- EU Instant Payments Regulation (IPR): adopted on 13 March 2024, it aims to accelerate instant payments across Europe. Covering euro-denominated credit transfers within the EU, it amends the SEPA Regulation and updates key directives, including the Settlement Finality Directive (SFD) and Payment Services Directive (PSD2). Implementation begins in 2025, opening up a whole new range of possibilities also for what concerns embedded finance.

- Markets in Crypto-Assets (MiCA): This significant regulatory framework, approved by the European Parliament in 2023, aims to unify and strengthen the European crypto market. While most provisions will take effect on 30 December 2024, rules governing asset-referenced tokens (Title III) and e-money tokens (Title IV) have been in force since 30 June 2024. MiCA was not the only remarkable event for the crypto market, as we saw the approval of the first U.S. Spot Bitcoin ETF, which marked another important milestone towards a deeper integration of digital assets into traditional finance, and Bitcoin nearing the $100,000 mark.

- EU Taxonomy and Corporate Sustainability Reporting Directive (CSRD): significant progress made in 2024 in implementing these regulations, expanding their scope and impact, and pushing the fintech sector to align with green finance goals and the acceleration of the climate fintech sub-sector. The EU Taxonomy now covers all six environmental objectives, while the CSRD extended sustainability reporting requirements to a broader range of companies. Still, the full integration of sustainability criteria in financial decision-making processes is still ongoing, presenting opportunities for fintech innovation in ESG data management and reporting.

- EU AI Act: This legislative framework, approved by the Council of the European Union on 21 May 2024, categorizes AI systems by risk levels and establishes specific requirements for high-risk applications, with the aim to ensure transparency, accountability, and compliance with ethical and safety standards. It entered into force on 1 August 2024, but the provisions will become applicable in stages.

The Year of Secondary Sales Boom in Fintech

The considerable growth in secondary sales reflects a broader trend toward liquidity in private markets, allowing early investors and employees to realize some of the value of their investments while companies remain private. The trend was particularly marked among UK-based fintech companies. A few prominent examples include:

- Monzo: Facilitated a secondary share sale valuing the company at £4.5 billion. Existing investors including StepStone Group and Singapore's sovereign wealth fund GIC participated, providing liquidity to employees.

- Stripe: Conducted a tender offer in the first half of the year at a $65 billion valuation, allowing employees to sell shares. Later, in November 2024, the company initiated another tender offer to repurchase shares at an increased valuation of approximately $70 billion.

- Revolut: Secured a $45 billion valuation in a share sale, in August 2024, which is set to deliver a $500 million windfall for its staff, solidifying its status as Europe’s most valuable private tech company.

- Moneybox: Carried out a secondary share sale that valued the company at £550 million, an 84% increase since its 2022 Series D round. The £70 million investment was mainly facilitated through this sale, with existing investors selling 10-15% of the current share capital.

Last but not least, 2024 saw the inaugural FIBE fintech festival, a definite highlight in a year packed with significant fintech developments. Now, as the year comes to an end and we look forward to some well-deserved holidays, we’re grateful for the progress made over the past twelve months and eager for what’s to come. Be sure to save a spot on your calendar for April 9–10, 2025, and join us in Berlin for the next—and best—FIBE yet!