Page content

The Impact of MiCA on the Crypto Industry

Reading Time: 4 Minutes

The Markets in Crypto Assets (MiCA) law, enacted by the EU Parliament on April 20, 2023, has been a focal point in the evolving narrative of digital assets within Europe. It emerged as a response to the increasing adoption and market presence of cryptocurrencies, acting as a catalyst of regulatory frameworks in the digital asset landscape.

The essence of regulatory frameworks like MiCA will be a common ground that could help the EU

crypto market grow stronger together, making it easier for businesses to operate across countries.

Balancing Act: Positives and Negatives of MiCA

Even with all optimistic reception within the crypto markets in the EU, some might say MiCA brings a blend of positive and negative repercussions for the crypto realm.

On one hand, it offers a structured legal framework, fostering transparency and consumer protection, which are critical in building trust and ensuring market integrity.

Consumers will be better informed about the risks, costs, and charges associated with dealing with crypto assets. MiCA also will support market integrity and financial stability by regulating public offers of crypto assets and introducing measures to tackle market manipulation and prevent money laundering and terrorist financing.

MiCA sets out clear rules for offering and trading crypto assets, requiring a 'white paper' to be published before launching a crypto asset, to inform the public. Especially for stablecoins, MiCA will mandate the issuers to have a presence in the EU and follow certain financial safeguards. Only non-fungible tokens (NFTs) are out-of-scope, but the European Commission will look at these again in late 2024.

Still talking about market integrity, MiCA is designed to promote financial stability in markets that have been historically volatile and, in many cases, prone to fraud. It ensures that all companies providing services in relation to crypto assets in the EU are uniformly regulated and supervised.

MiCA's introduction could trigger a shift in market share towards regulated crypto businesses, pushing aside unregulated ones, especially those based offshore. This move towards regulation reflects a larger trend of legitimization and standardization in the crypto industry. By following MiCA’s rules, businesses can build trust with investors, which is key to thriving in the long term.

However, for smaller or newer crypto businesses, these rules can be quite challenging. They might need to change how they operate to meet these new rules. For instance, they will need to show that they are being open and fair with their customers, which could mean changing their paperwork or systems.

They also need to get an operational license - this license is granted by the regulatory authorities in the EU to crypto asset service providers, allowing them to operate legally within the region. It's a formal approval indicating that the entity has met the required standards set by the MiCA regulation, ensuring they comply with the legal and operational framework laid down by the EU.

On top of that, MiCA asks crypto businesses to have these new compliance methods in place to manage any risks and to keep their operations running smoothly, mostly commonly known as operational resilience.

These changes might take a while to be implemented, as setting up these systems can be expensive and complicated. Also, there are new requirements for reporting, which means the businesses need to regularly provide specific information about their operations to the authorities. All these new requirements mean more work and costs for crypto businesses. While these rules are aimed at making the crypto market safer and more reliable, they could make it harder, especially for smaller businesses, to keep up with all the new demands.

MiCA's Jurisdiction: What's In and What's Out

MiCA is designed to regulate certain crypto assets, but it won't apply to those already covered by existing EU financial services regulation, like MiFID (Markets in Financial Instruments Directive) financial instruments, structured deposits, or securitisation positions. ESMA (European Securities and Markets Authority) will prepare the guidelines to clarify the distinction between crypto assets regulated by MiCA and traditional financial instruments.

Another type of digital asset the MiCA won’t cover are non-fungible tokens (NFTs), but the European Commission will look at these again in late 2024.

Additionally, MiCA doesn’t cover lending and borrowing of crypto assets, nor does it apply to crypto assets that can’t be transferred from one holder to another. This clear distinction will help to show what falls under MiCA’s purview and what doesn’t.

Rollout Roadmap: Implementing MiCA

MiCA offers an optional grandfathering period extending from 30 December 2024 to 1 July 2026, during which EU Member States can allow existing crypto asset service providers in their jurisdiction to continue operations.

However, there's concern from ESMA (European Securities and Markets Authority) regarding the potential extensive use of this option, especially in cases where current national rules are not as thorough as MiCA. ESMA proposes shortening this period to a maximum of 12 months and has requested Member States to confirm this change to the European Commission and ESMA by the end of 2023.

The Road Ahead for Crypto Assets After MiCA

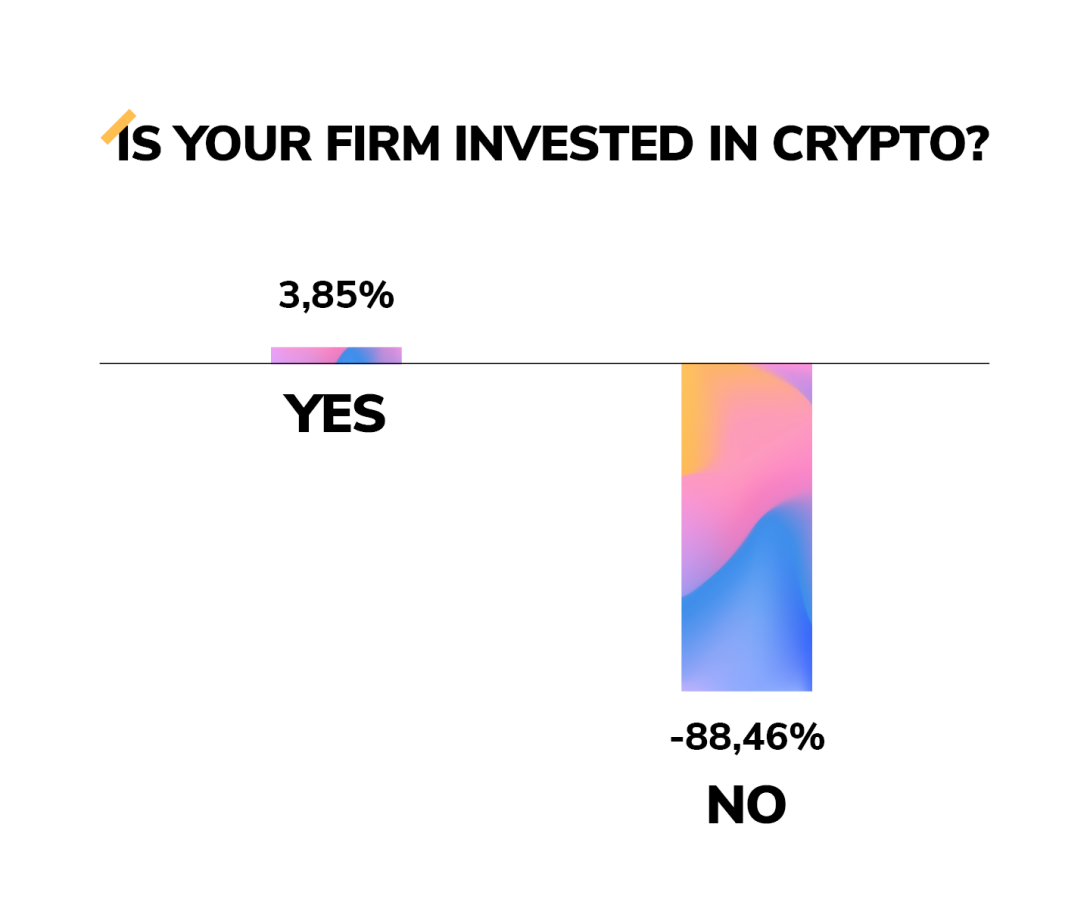

MiCA is set to significantly influence institutional adoption and investment in the EU's crypto market by clearing regulatory uncertainties that have so far deterred institutional involvement. According to a Bloomberg survey, only 4% of institutional funds in Europe have exposure to crypto assets, with regulatory uncertainty being a major concern holding them back.

This scenario is likely to change with the introduction of MiCA, as it provides a well-defined regulatory framework which can instill a higher level of confidence among institutional investors.

Also, MiCA aims to support innovation while preserving financial stability and protecting investors, thereby creating a more attractive and safer environment for institutional investments.

The expectation is that major European banks will roll out crypto asset services in the next 48 months, covering aspects like custody, exchange, or the issuance of e-money tokens or asset-referenced tokens, often referred to as stablecoins. This development is a strong indication of the growing institutional interest and investment in the EU crypto market spurred by MiCA.

MiCA's Regulatory Clarity Fuels Institutional Investment Surge in EU Crypto Market

MiCA's role in creating a conducive environment for institutional investments is instrumental in driving the maturation and growth of the EU crypto ecosystem. Through reducing regulatory ambiguities and fostering a more regulated and standardized market, MiCA is setting the stage for substantial institutional capital inflow into the EU crypto market, which can, in turn, contribute significantly to its growth and stability.