Page content

How the Blockchain Revolution of DeFi Challenges Traditional Finance

Reading Time: 4 Minutes

New ways to bank are emerging with blockchain banking. It uses the tech behind cryptocurrencies to create a more open and efficient financial system.

In this article, we will look into how decentralized banking can work in traditional banking and what the future holds. We will break down the key ideas and see how blockchain for banks might create a more inclusive financial world.

Traditional Finance (TradFi): Security and stability at cost of innovation?

Traditional banks, also known as Traditional Finance (TradFi), have been the cornerstones of our financial world for centuries, offering a set of services from savings to loans. They prioritize security and stability, but this often comes at the cost of innovation and accessibility,

TradFi is being disrupted by the emergence of blockchain and fintech, driven by recent trends in banking that signal a shift towards more transparent, efficient, and customer-centric services. This transition is not without its banking challenges, as traditional institutions struggle with bank charges and operational models that seem increasingly outdated.

It’s becoming clear that the banking industry trends are paving the way for a decentralized bank system, often referred to as Decentralized Finance (DeFi), promising to redefine our relationship with money and how we interact with financial services.

DeFi Explained: How Decentralized Finance Is Reimagining Banking

What is Decentralized Finance (DeFi)?

DeFi, or decentralized finance, is blockchain-enabled financial services without intermediaries. Unlike traditional banks that work in a centralized system, DeFi operates on a peer-to-peer network through decentralized exchanges (DEXs).

The core building block of DeFi is crypto - digital assets that fuel this new financial system. These crypto assets open the door to innovative services like dex trading (decentralized exchange trading) and decentralized perpetual exchanges (similar to traditional perpetual exchanges, but without a central authority to manage them).

But DeFi goes beyond just crypto trading. It encompasses a broad spectrum of financial services built on the principles of security and transparency of blockchain technology. From facilitating direct peer-to-peer loans to offering innovative financial instruments, DeFi is setting the stage for an almost complete transformation of the financial sector.

Centralized Exchanges (CEX) and Decentralized Exchanges (DEX): Understanding the Differences

Centralized exchanges (CEXs) are like traditional stock exchanges. They act as intermediaries, holding user funds and overseeing trades. This offers a familiar experience but can have higher fees and limited access to certain cryptocurrencies.

In comparison, Decentralized exchanges (DEXs), are peer-to-peer marketplaces built on blockchain technology. Users control their own crypto trading directly with each other, offering greater transparency and potentially lower fees. However, DEXs can have less liquidity (fewer buyers and sellers) and can be more complex to use.

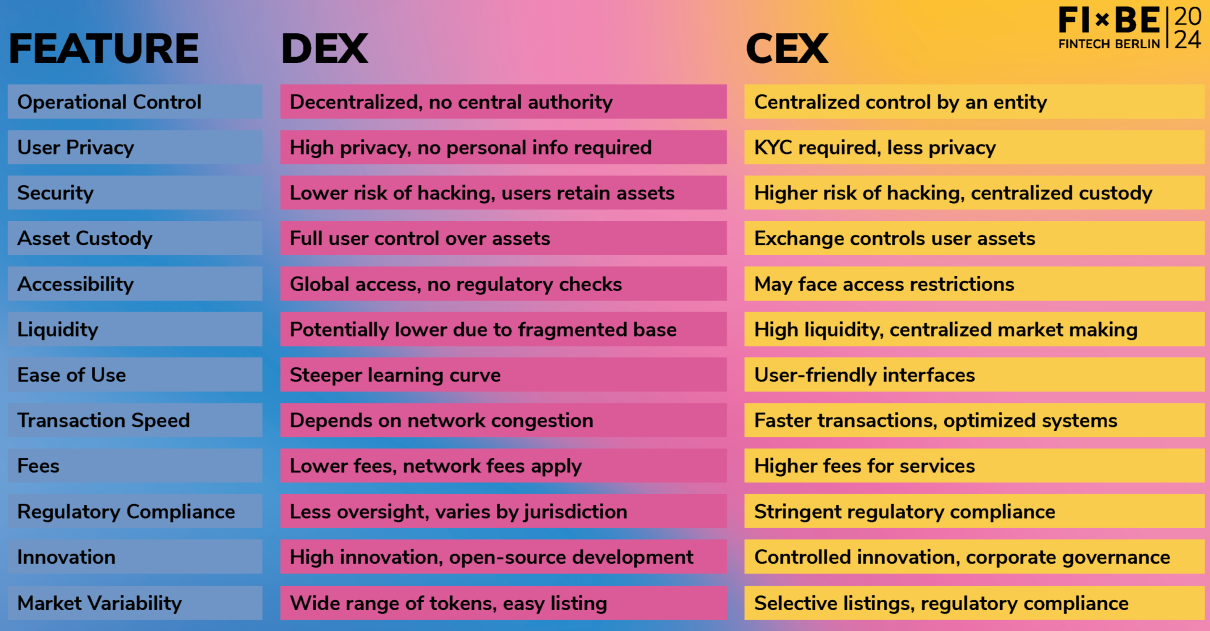

Comparison of different features in regards to DEX and CEX

As DeFi continues to evolve, it will challenge traditional banking models but it also will introduce new challenges.

For instance, DeFi crime – hacks, scams, and other malicious activities – is a growing concern. Additionally, regulatory bodies are still developing adequate legislation, trying to develop frameworks for this new financial landscape.

Despite these challenges, the potential of decentralized banking to solve traditional banking challenges and to embrace recent trends in banking is undeniable. It has the power to redefine financial services for a more inclusive and accessible global economy.

Facing the Future: The Integration of DeFi and TradFi

The key differences lie in how each system tackles challenges and embraces trends. TradFi faces pressure to adapt to banking challenges from high banking fees to bureaucracy and lack of innovation, while DeFi thrives on constant DeFi development to meet user needs.

This battle between TradFi and DeFi represents a crossroad in the banking evolution. Blockchain for banks has the potential to bridge the gap between these two worlds, fostering collaboration and leveraging the strengths of each.

As we explore the future financial landscape, the intersection of Decentralized Finance (DeFi) and Traditional Finance (TradFi) becomes increasingly significant. This convergence points to a transformative era for the banking evolution, where the innovative potential of blockchain and fintech meets the stability and regulatory framework of traditional systems.

Imagine traditional banks adopting fintech solutions or integrating aspects of DeFi for specific services. This future financial landscape could be more inclusive, efficient, and secure, offering everyone the financial tools they need.

Here are some examples:

Blockchain banking benefits for TradFi

- Loan Automation: Smart contracts streamline loan approvals and calculations.

- Secure KYC: Blockchain-based identity verification improves privacy and reduces fraud.

- Higher Yields: Offer DeFi yield farming for attractive deposit returns.

- DEX Access: Integrate with DEXs for broader asset trading options.

- Faster Payments: Utilize blockchain for efficient and cost-effective cross-border payments.

- Improved Liquidity: Leverage DeFi for better liquidity management and reduced reserve needs.

- DeFi Investments: Develop investment products incorporating DeFi for crypto-interested investors

The intersection of Decentralized Finance (DeFi) and Traditional Finance (TradFi) marks a pivotal moment in the evolution of the financial industry. The potential for traditional banks to adopt DeFi aspects offers exciting opportunities for innovation, pushing the boundaries of what's possible in banking and fintech.

The future of finance lies in collaboration and integration, leveraging the strengths of both DeFi and TradFi to build a financial system that is accessible to all.