Page content

FIBE Webinars

Fintech Talks across the World

In our commitment to fostering continuous engagement and collaboration within the FIBE community, we are excited to introduce a new format:

FIBE Webinars - Fintech Talks across the World.

These webinars will provide an opportunity to connect digitally throughout the year, bridging distances and bringing together experts and enthusiasts from around the world.

Each webinar will focus on a different country, highlighting its unique financial innovations, historical context, and future outlook. We will feature three distinguished experts representing a diverse array of industries, including banking, fintech, and technology or politics. This will ensure a comprehensive view of each country's financial landscape.

Join us for an engaging one-hour session featuring expert talks followed by a Q&A segment.

These webinars - free of charge - will offer a platform for learning, discussion, and networking, allowing the FIBE community to stay connected and informed beyond our annual event.

The next webinar is coming after FIBE 2025 (April 9th & 10th, 2025).

More webinar editions are coming up soon: Stay tuned and register for our newsletter.

Previous Webinars

The fintech sector in Africa holds significant potential to drive greater economic prosperity. Nearly half of the continent's 1,000 fintech companies have been established within the last six years, collectively raising around $6 billion in equity financing since 2000.

This dynamic and rapidly expanding industry offers considerable room for further growth.

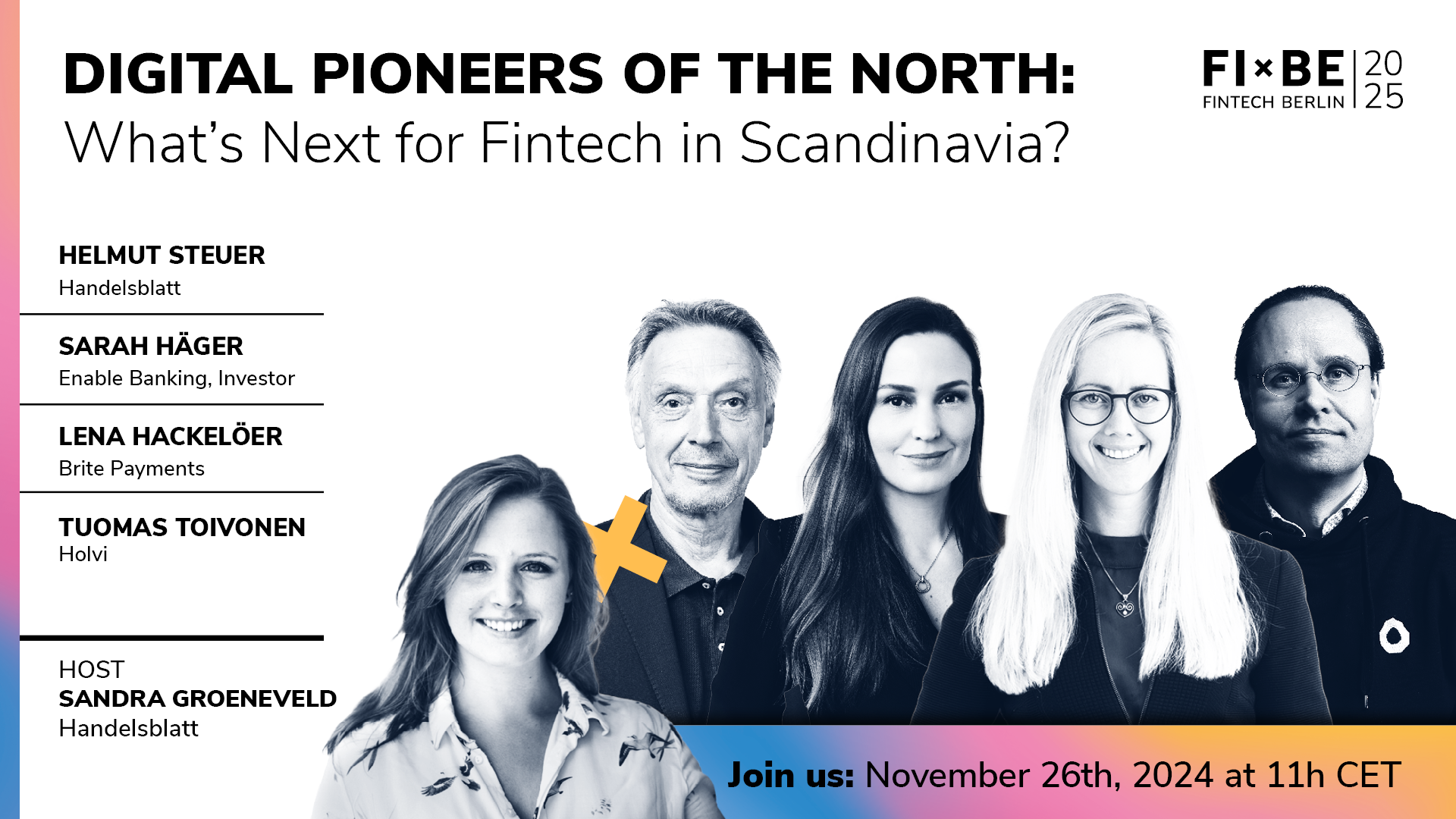

The Nordics are a region renowned for its rapid innovation, strong regulatory environment, and thriving startup ecosystem. From digital banking to blockchain technology, the Nordic countries are at the forefront of redefining the financial landscape.

Let's discover best practices, and learn how to leverage the Nordic fintech wave to stay ahead in the global market.

China - with its booming and innovative financial centres Hong Kong and Shanghai - is leading the world in fintech innovation, offering immense business opportunities. However, entering this dynamic, regulated and highly competitive market requires a deep understanding and strategic approach.

This session will explore the key drivers for success in the sector, the regulatory framework, access to funding and strategies to overcome cultural and operational challenges.

In case of questions

Nicole Bastian, Chief Foreign Editor, Handelsblatt

Nicole Bastian has been chief foreign editor at Handelsblatt since 2014. And this is how she got there: After studying East Asian studies with a focus on economics in Duisburg and Kyoto, she completed an traineeship at the German Press Agency (dpa). Nicole Bastian then worked as an editor in dpa's business department in Hamburg and as a business reporter in Berlin. In 2002 she joined the Handelsblatt. As Tokyo correspondent, she spent five years reporting on business and politics in Japan, South Korea and North Korea. In spring 2007, just as the financial crisis broke out, she moved to Frankfurt as a banking correspondent. In 2011 she took over as head of the finance desk.

Mabel Fu, Director of Programs, Asia at Start2 Group

Mabel Fu is the Director of Programs for Asia at Start2 Group where she leads a dynamic team across China, India, Japan, South Korea and Southeast Asia to drive startup success in the continent and support corporations with their open innovation activities. Prior to joining Start2 Group, she held various roles at Linde plc, including Onsite Account Management and Corporate Digitalization, where she led project teams consisting of startups, data scientists, and business units to utilize technology for enhancing business processes and operational efficiency.

Helene Li Co-Founder & CEO , GoImpact Capital Partners

A seasoned management consultant and finance industry professional, Helene has held various senior management positions in Strategic Planning, Marketing and Branding throughout her career which includes tenure at global consulting giants Boston Consulting Group and Willis Towers Watson.

Prior to founding GoImpact platform developed to accelerate the adoption of Sustainable Finance, Helene was Managing Director and Head of Strategic Planning, Brand and Communications Asia Pacific for BNP Paribas Wealth Management, a role she has held for 5 years. She also held similar roles at J.P. Morgan Private Bank and Swiss wealth management firm Lombard Odier. In these capacities, she was instrumental in advancing the agenda of Sustainable Finance and Investments across a broad client base of family offices and asset owners.

Minwen Lu, Head of Asia, Unique

Minwen Lu is the Head of Asia at Unique, based in Singapore. Minwen Lu's role at Unique involves leading the company's operations in Asia, focusing on the implementation of AI solutions for the financial services industry, and managing key client relationships and projects. She brings extensive experience from previous roles at SAP, Coresystems. She holds a Master's and Bachelor’s degree in Finance and Accounting from Rotterdam University of Applied Sciences.